California’s auto insurance market is a complex landscape, influenced by a multitude of factors that can significantly impact premiums. From population density and traffic patterns to accident rates and the state’s strict regulations, navigating this terrain requires a thorough understanding of the key drivers of cost.

This guide delves into the intricacies of California’s auto insurance landscape, providing insights into the factors that shape premiums, strategies for securing affordable coverage, and essential tips for safe driving and accident prevention. We’ll explore the role of technology in shaping the future of auto insurance, offering a comprehensive overview of this crucial aspect of personal finance.

Understanding California’s Auto Insurance Market

California’s auto insurance market is a complex landscape shaped by various factors, making it crucial to understand the dynamics at play to find the most affordable coverage.

Factors Influencing Auto Insurance Costs

Several factors contribute to the cost of auto insurance in California. Understanding these factors can help you navigate the market effectively and find the best value for your needs.

- Population Density and Traffic Patterns: California’s dense population and heavy traffic contribute to higher accident rates, leading to increased insurance premiums. Areas with higher population density and congested roads typically experience more accidents, leading to higher claims and ultimately, higher insurance costs.

- Accident Rates: The frequency of accidents in a particular region directly impacts insurance premiums. Areas with higher accident rates generally have higher insurance costs due to the increased likelihood of claims.

- Cost of Vehicle Repairs: The cost of vehicle repairs in California can vary significantly depending on factors like the availability of parts and labor costs. Higher repair costs in certain regions can translate to higher insurance premiums.

- Driving Habits and Demographics: Individual driving habits and demographics play a significant role in determining insurance premiums. Factors such as age, driving history, and driving experience influence risk assessments, impacting the cost of coverage.

- Cost of Living: The overall cost of living in California, including housing, healthcare, and other expenses, can influence insurance premiums. Higher costs of living can lead to higher insurance costs as well.

Role of the California Department of Insurance

The California Department of Insurance (CDI) plays a crucial role in regulating the state’s auto insurance industry. The CDI ensures that insurance companies operate fairly and transparently, protecting consumers from unfair practices.

- Licensing and Oversight: The CDI licenses and oversees insurance companies operating in California, ensuring they meet specific requirements and standards. This oversight helps maintain the integrity and stability of the auto insurance market.

- Consumer Protection: The CDI works to protect consumers by investigating complaints, enforcing regulations, and providing educational resources. This ensures that consumers have access to fair and transparent insurance practices.

- Rate Regulation: The CDI reviews and approves insurance rates, ensuring they are reasonable and reflect the actual costs of providing coverage. This helps prevent excessive rate increases and protects consumers from unfair pricing.

Types of Auto Insurance Coverage

California law requires drivers to carry specific types of auto insurance coverage. Understanding the different types of coverage can help you make informed decisions about your insurance needs.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. It covers the costs of medical bills, lost wages, and property repairs up to the limits of your policy.

- Collision Coverage: This coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of who is at fault. It covers the cost of repairs or replacement, minus your deductible.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters. It covers the cost of repairs or replacement, minus your deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and property damage up to the limits of your policy.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of who is at fault, if you are injured in an accident. It covers the cost of medical bills, up to the limits of your policy.

Key Factors Affecting Auto Insurance Premiums

In California, auto insurance premiums are influenced by a multitude of factors that insurers use to assess the risk associated with each driver. Understanding these factors can empower drivers to make informed decisions about their coverage and potentially lower their premiums.

Driving History

Your driving history is a crucial factor in determining your auto insurance premium. A clean driving record with no accidents, violations, or claims will typically result in lower premiums. Conversely, a history of accidents, traffic violations, or claims can significantly increase your premiums. Insurers view drivers with a history of accidents as higher risk, as they are more likely to be involved in future accidents.

Age

Age is another important factor considered by insurers. Younger drivers, particularly those under 25, are generally considered higher risk due to their lack of experience and higher likelihood of being involved in accidents. As drivers gain experience and reach their mid-thirties, their premiums tend to decrease. Senior drivers, however, may face higher premiums due to potential health issues or declining driving skills.

Vehicle Type

The type of vehicle you drive significantly affects your auto insurance premium. High-performance vehicles, sports cars, and luxury cars are typically more expensive to repair and insure due to their higher value and potential for greater damage in an accident. Conversely, smaller, less expensive vehicles tend to have lower premiums.

Credit Score

Surprisingly, your credit score can also play a role in determining your auto insurance premium. Insurers use credit scores as an indicator of financial responsibility, believing that individuals with good credit are more likely to pay their insurance premiums on time. While this practice is controversial, it is legal in California and is used by some insurers.

Location

Your location in California is another factor that can influence your auto insurance premiums. Areas with higher crime rates, traffic congestion, and population density are generally considered higher risk and may result in higher premiums. For example, drivers in urban areas like Los Angeles or San Francisco may face higher premiums compared to drivers in rural areas.

Pricing Strategies of Insurance Companies

Insurance companies in California employ various pricing strategies to attract and retain customers. Some companies may offer lower premiums for drivers with good driving records and credit scores, while others may focus on offering comprehensive coverage options at competitive prices. Understanding the pricing strategies of different insurers can help you find the best coverage at the most affordable price.

Finding Affordable Auto Insurance Options

Navigating California’s complex auto insurance market can be daunting, especially when seeking the most affordable coverage. Understanding the factors influencing premiums and implementing effective strategies can significantly reduce your insurance costs.

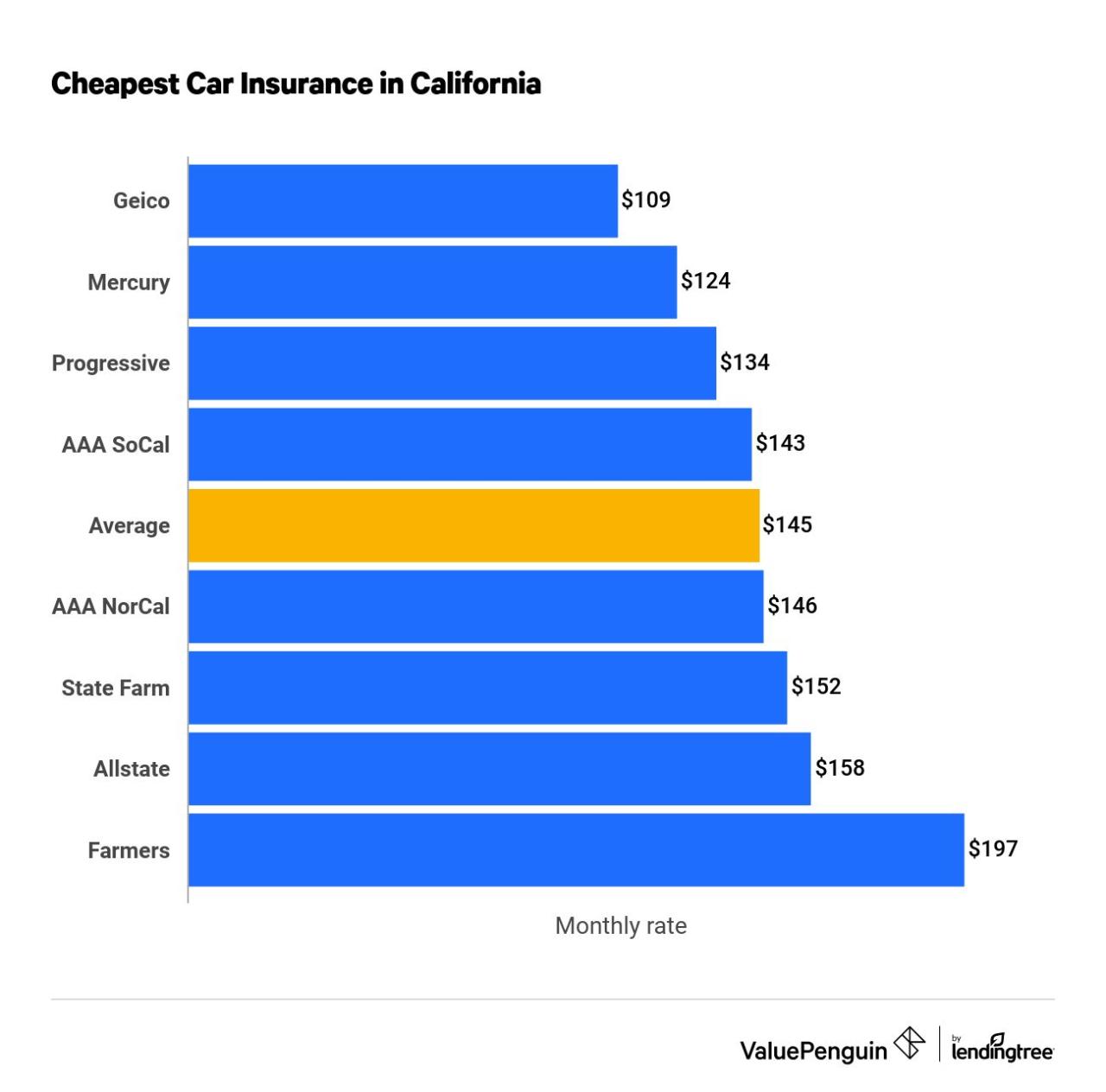

Finding the Cheapest Auto Insurance Options

Finding the cheapest auto insurance in California involves a comprehensive approach that combines research, comparison, and negotiation. This section Artikels a step-by-step guide for individuals seeking the most affordable coverage.

- Gather Information and Quotes: Begin by gathering essential information, including your driving history, vehicle details, and coverage needs. Use online comparison tools, such as those provided by insurance aggregators like Insurify, Policygenius, and NerdWallet. These platforms allow you to compare quotes from multiple insurers simultaneously, streamlining the process and identifying the most competitive rates.

- Explore Discounts and Bundling Options: Many insurers offer discounts for safe driving, good credit scores, multiple policy bundling, and other factors. Research these discounts and determine your eligibility. Bundling your auto insurance with homeowners or renters insurance can often lead to significant savings. Contact your current insurer to explore potential bundling options.

- Negotiate with Insurers: Once you’ve identified a few competitive quotes, don’t hesitate to negotiate with insurers. Emphasize your good driving record, any relevant discounts you qualify for, and your willingness to consider different coverage options. Be prepared to explain your rationale and negotiate for the best possible rates.

- Review Your Coverage Regularly: Auto insurance needs can change over time. Regularly review your coverage to ensure it remains adequate and adjust it as needed. You may find that your current coverage is no longer necessary or that you can lower your premiums by reducing coverage levels without compromising your protection.

Tips and Strategies for Lowering Premiums

Numerous strategies can help reduce your auto insurance premiums in California. These strategies often involve adjusting your driving habits, vehicle choices, and insurance policies.

- Maintain a Good Driving Record: A clean driving record is essential for securing lower premiums. Avoid traffic violations, accidents, and other driving infractions that can lead to increased insurance costs.

- Consider a Safer Vehicle: Choosing a vehicle with safety features and a lower theft risk can influence your insurance rates. Research models with advanced safety technologies, such as anti-lock brakes and electronic stability control, which often translate into lower premiums.

- Increase Your Deductible: A higher deductible generally results in lower premiums. Consider raising your deductible if you’re comfortable assuming a higher financial responsibility in case of an accident. This strategy can lead to substantial savings over time.

- Explore Payment Options: Paying your premium in full or opting for a shorter payment term can sometimes result in lower rates. Check with your insurer to see if they offer discounts for annual or semi-annual payments.

Resources and Websites for Auto Insurance Quotes

Numerous online resources and websites offer free auto insurance quotes and comparison tools, enabling you to efficiently compare rates from multiple insurers.

- Insurify: Insurify is a popular online platform that allows you to compare quotes from various insurers. It aggregates data from multiple companies and provides a comprehensive overview of available options.

- Policygenius: Policygenius is another reputable platform that provides free auto insurance quotes and comparison tools. It offers a user-friendly interface and simplifies the process of finding the best coverage at competitive rates.

- NerdWallet: NerdWallet is a well-known financial website that includes a dedicated section for auto insurance. It provides tools for comparing quotes, exploring discounts, and understanding coverage options.

Understanding Insurance Discounts and Benefits

Securing the cheapest auto insurance in California often involves taking advantage of available discounts and benefits. These savings can significantly reduce your overall premium, making your policy more affordable.

Understanding Common Auto Insurance Discounts

Discounts are a crucial aspect of lowering your auto insurance costs. Here’s a breakdown of common discounts available in California:

- Good Driver Discounts: Insurance companies reward drivers with clean driving records by offering discounts. These discounts can be substantial, especially for those with no accidents or traffic violations.

- Safe Vehicle Discounts: Cars with advanced safety features, such as anti-theft devices, airbags, and anti-lock brakes, often qualify for discounts. These features help reduce the risk of accidents and injuries, making your vehicle more appealing to insurance companies.

- Multi-Policy Discounts: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can lead to significant savings. Insurance companies often offer discounts for combining multiple policies with them.

- Other Discounts: Additional discounts might be available based on factors like:

- Payment Method: Paying your premium in full or setting up automatic payments can lead to discounts.

- Membership Organizations: Being a member of certain organizations, like AAA or AARP, can offer discounts.

- Student Discounts: Good students with high GPAs might qualify for discounts.

Choosing an Insurance Company with a Strong Financial Rating and Excellent Customer Service

Beyond discounts, the financial stability and customer service of your chosen insurance company are crucial. A financially sound insurer is more likely to be able to pay claims promptly and fairly. Excellent customer service ensures you receive timely and helpful assistance when you need it.

- Financial Rating: Look for insurance companies with strong financial ratings from organizations like A.M. Best or Standard & Poor’s. These ratings indicate the company’s ability to meet its financial obligations.

- Customer Service: Research customer reviews and ratings to assess the company’s reputation for customer service. Consider factors like response times, claim processing efficiency, and overall satisfaction.

Understanding the Terms and Conditions of Your Auto Insurance Policy

Before signing up for any auto insurance policy, carefully review the terms and conditions. This ensures you understand your coverage, deductibles, and other key aspects of the policy.

- Coverage: Make sure you understand the types of coverage included in your policy, such as liability, collision, comprehensive, and uninsured motorist coverage.

- Deductibles: Review the deductible amounts for different types of coverage. A higher deductible generally leads to a lower premium, but you’ll pay more out of pocket if you file a claim.

- Exclusions: Be aware of any exclusions in your policy, which are situations where coverage might not apply.

Navigating the Insurance Claims Process

Filing an auto insurance claim in California can be a stressful experience, but understanding the process and your rights can help make it smoother. This guide Artikels the steps involved, tips for documentation, and strategies for negotiating a settlement.

Filing a Claim

After an accident, it’s crucial to act promptly and accurately to ensure your claim is processed efficiently. Here’s a step-by-step guide:

- Contact Your Insurance Company: Immediately report the accident to your insurance company, even if the damage seems minor. They will provide you with instructions on how to proceed.

- File a Police Report: If the accident involved injuries, property damage exceeding $1,000, or a hit-and-run, you are required to file a police report. This document is essential for your claim.

- Gather Evidence: Document the accident scene with photographs and videos. Record the names and contact information of all parties involved, including witnesses.

- Submit Claim Documents: Your insurance company will provide you with claim forms and instructions. Complete these forms accurately and thoroughly, and include all relevant documentation, such as the police report, photographs, and medical records.

Communicating with Your Insurance Company

Effective communication with your insurance company is key to a successful claim.

- Be Prompt and Clear: Respond to your insurance company’s requests for information promptly and clearly. Avoid delays or misunderstandings.

- Keep Records: Maintain a detailed record of all communication with your insurance company, including dates, times, and the content of conversations.

- Be Polite and Professional: Even if you are frustrated, maintain a respectful tone in your interactions with the insurance company.

Negotiating a Settlement

Once your insurance company has reviewed your claim, they will offer a settlement.

- Review the Offer: Carefully review the settlement offer and consider if it fairly compensates you for your losses.

- Negotiate: If you believe the offer is too low, you can negotiate with your insurance company. Be prepared to provide supporting documentation, such as medical bills and repair estimates.

- Legal Assistance: If you cannot reach a satisfactory settlement, you may consider seeking legal advice from an experienced attorney specializing in insurance claims.

Role of a Lawyer

An attorney can be a valuable asset in navigating the insurance claims process, especially in complex or disputed cases.

- Legal Expertise: A lawyer understands the legal intricacies of insurance claims and can ensure your rights are protected.

- Negotiation Skills: Attorneys are skilled negotiators and can help you obtain a fair settlement from your insurance company.

- Litigation: If a settlement cannot be reached, an attorney can represent you in court.

Understanding the Role of Technology in Auto Insurance

The insurance landscape is rapidly evolving, driven by technological advancements that are transforming how insurers operate and how consumers access and manage their policies. This section delves into the impact of technology on auto insurance, specifically exploring the influence of telematics, online platforms, and innovative insurance products.

Telematics and Usage-Based Insurance

Telematics devices, such as GPS trackers and smartphone apps, collect data on driving behavior, enabling insurers to assess risk more accurately and offer personalized premiums. Usage-based insurance (UBI) programs leverage this data to reward safe drivers with lower rates.

- Data Collection: Telematics devices track factors like speed, acceleration, braking, time of day, and mileage, providing a detailed picture of driving habits.

- Risk Assessment: Insurers analyze this data to identify safe drivers who are less likely to be involved in accidents, leading to lower premiums for them.

- Personalized Pricing: UBI programs offer discounts based on driving behavior, allowing individuals to control their premiums by adopting safer driving practices.

A study by the Insurance Institute for Highway Safety (IIHS) found that UBI programs can lead to a 10-20% reduction in accidents, demonstrating their effectiveness in promoting safer driving.

Online Platforms and Mobile Apps

The rise of online platforms and mobile apps has revolutionized the way people purchase and manage auto insurance. These platforms offer convenience, transparency, and personalized experiences.

- Online Quoting and Purchasing: Consumers can now obtain quotes and purchase policies online, eliminating the need for traditional face-to-face interactions with agents.

- Real-time Policy Management: Mobile apps provide access to policy information, payment history, and claims management tools, empowering customers to manage their insurance on the go.

- Personalized Recommendations: AI-powered algorithms analyze customer data to offer personalized recommendations for coverage options, discounts, and other relevant services.

Companies like Lemonade and Root have emerged as pioneers in the digital insurance space, leveraging technology to streamline the insurance process and enhance customer experiences.

Innovative Insurance Products and Services

Technology is enabling the development of innovative insurance products and services designed to cater to the evolving needs of modern drivers.

- Pay-per-mile Insurance: This model charges premiums based on actual miles driven, appealing to low-mileage drivers who may benefit from lower costs compared to traditional policies.

- Ride-sharing Insurance: Specific policies cater to drivers who use ride-sharing platforms like Uber and Lyft, providing coverage for both personal and commercial use.

- Autonomous Vehicle Insurance: As autonomous vehicles become more prevalent, insurers are developing specialized policies to address the unique risks associated with self-driving cars.

The future of auto insurance is likely to be characterized by greater personalization, data-driven risk assessment, and innovative solutions that enhance safety and affordability for all drivers.

Tips for Safe Driving and Accident Prevention

Safe driving practices are essential for protecting yourself and others on the road. By adopting a defensive driving mindset and prioritizing safety, you can significantly reduce your risk of accidents and potentially lower your auto insurance premiums.

Defensive Driving Techniques

Defensive driving involves anticipating potential hazards and taking proactive measures to avoid accidents. Here are some key techniques:

- Maintain a Safe Following Distance: This allows you ample time to react to sudden stops or changes in traffic flow. A good rule of thumb is to maintain a distance of at least three seconds behind the vehicle in front of you.

- Scan the Road Ahead: Be aware of your surroundings, including other vehicles, pedestrians, cyclists, and road conditions. Look ahead, to the sides, and in your rearview mirror.

- Avoid Distractions: Cell phone use, texting, eating, and adjusting the radio can all impair your driving ability. Focus your attention on the road and avoid distractions.

- Be Prepared for Unexpected Situations: Always be ready for sudden stops, lane changes, or other unexpected events. This includes being aware of weather conditions and potential road hazards.

Driver Safety Courses

Attending a driver safety course can provide valuable insights and skills to improve your driving habits and reduce your risk of accidents. These courses typically cover topics such as:

- Defensive Driving Techniques: Learn practical strategies for avoiding accidents and managing high-risk situations.

- Traffic Laws and Regulations: Gain a deeper understanding of traffic laws and how to comply with them safely.

- Vehicle Handling and Control: Develop skills for handling your vehicle effectively in various driving conditions.

- Risk Management and Awareness: Learn to identify and manage driving risks to minimize the chances of accidents.

Car Maintenance Tips

Regular car maintenance is crucial for ensuring your vehicle operates safely and reliably. Here are some tips:

- Check Tire Pressure Regularly: Proper tire pressure ensures optimal handling and braking performance. Underinflated tires can lead to blowouts and increased stopping distances.

- Maintain Brake System: Regular brake inspections and maintenance are essential for ensuring your brakes function properly. Worn brake pads or rotors can lead to reduced braking effectiveness.

- Change Oil and Filters: Regular oil changes and filter replacements keep your engine running smoothly and prevent premature wear and tear.

- Inspect Lights and Windshield Wipers: Ensure all lights are functioning correctly and replace worn windshield wipers to maintain visibility in all weather conditions.

Additional Resources and Information

Navigating the complex world of auto insurance in California can be challenging. This section provides a comprehensive guide to additional resources and information that can help you make informed decisions about your coverage.

Reputable Organizations and Websites

A variety of organizations and websites offer valuable information and resources to assist California drivers in understanding auto insurance.

- California Department of Insurance (CDI): The CDI is the primary regulatory body for insurance in California. It provides comprehensive information about auto insurance, including consumer guides, FAQs, and complaint procedures.

- California Insurance Information and Advocacy Network (CIIN): CIIN is a non-profit organization dedicated to educating consumers about insurance issues. It offers a wealth of information on auto insurance, including tips for finding affordable coverage and navigating the claims process.

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that works to regulate insurance companies. Its website provides information about insurance issues, including consumer protection resources and information about insurance fraud.

Government Resources and Consumer Protection Agencies

California provides several government resources and consumer protection agencies to assist drivers with insurance-related issues.

- California Department of Motor Vehicles (DMV): The DMV is responsible for regulating vehicle registration and driver licensing in California. It provides information about insurance requirements for drivers and vehicles.

- Consumer Affairs Division of the California Department of Justice: This division helps consumers resolve disputes with businesses, including insurance companies. It offers information on consumer rights and provides resources for filing complaints.

- California Public Utilities Commission (CPUC): The CPUC regulates insurance companies that offer coverage for automobiles used for transportation network companies (TNCs) like Uber and Lyft.

Filing a Complaint Against an Insurance Company

If you have a complaint against an insurance company in California, you can file a complaint with the CDI. The CDI will investigate your complaint and attempt to resolve the issue.

- File a complaint online: The CDI offers an online complaint form that you can access on its website.

- File a complaint by mail: You can also file a complaint by mail. The CDI’s mailing address is available on its website.

- File a complaint by phone: You can also file a complaint by phone by calling the CDI’s consumer hotline.

Closing Notes

In the end, finding the cheapest auto insurance in California requires a combination of informed decision-making, proactive measures to reduce risk, and a thorough understanding of the market. By leveraging the strategies and resources Artikeld in this guide, drivers can navigate this complex landscape and secure affordable coverage that meets their specific needs.